Financial pyramids — are fraudulent schemes promising high returns on investments by attracting new participants. These schemes often lead to significant financial losses for participants. It is important to understand how to recognize such fraudulent schemes, what signs they have, and how to avoid investing in such offers.

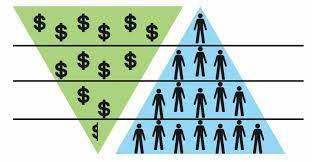

A financial pyramid — is a scheme where payments to existing participants are made from the contributions of new clients, rather than from profits from real investment activities. This structure requires a constant influx of new investors to ensure payouts. As soon as the influx of new users slows down, the structure collapses, leaving many investors without funds.

History and Development of Ponzi Schemes

Ponzi schemes got their name from the Italian swindler Charles Ponzi, who created the first financial pyramid in the 1920s. The essence of the scheme was the promise of high returns from operations with international postal coupons.

The fraudster used funds from new investors to pay interest to previous ones, creating the illusion of stable profit. However, when the volume of new deposits began to decline, the scheme collapsed, and many lost their money.

In the 21st century, similar schemes continue to deceive people worldwide, using the internet and social media to promote their services. History clearly demonstrates dozens of successful financial pyramids, such as MMM and others, which attract tens of thousands of naive investors with promises of easy income.

How to Recognize a Financial Pyramid

Learning to recognize financial pyramids before becoming a participant is a key factor in protecting your investments. There are several main signs that can help you identify potentially dangerous schemes.

The first and most obvious sign — is promises of high returns that significantly exceed average market rates. If you are offered guaranteed high profits with minimal risks, it is most likely a scam. It should be understood that real profit is always accompanied by certain risks.

Financial pyramids usually hide their working schemes. If you are not provided with reports on income and expenses, and not explained how profit is generated, this is a serious signal that the scheme may be fraudulent.

Fraudsters often resort to various psychological tricks to make the client increase the investment amount and discourage withdrawals. They may create a sense of urgency, claiming that the offer is limited by time or the number of participants. If you are persistently asked to make a quick decision, be wary. Consider the offer carefully and do not rush with investments.

Signs of Pyramid Schemes

To protect yourself from fraudulent financial schemes, you need to learn to recognize their main signs, which can help you distinguish a financial pyramid from a legitimate investment company.

Signs of Pyramid Schemes:

- Aggressive marketing. Such fraudsters often use aggressive methods to promote their product, an abundance of intrusive advertising does not inspire confidence in the success and reliability of the project.

- Numerous bonuses and a referral program to attract new users.

- Exaggerated marketing promises. Fraudsters claim that profit is guaranteed and risks are minimal. If the advertising materials speak of "safe and profitable" investments, this is a reason to think.

- Lack of licenses from financial regulators. Legal financial institutions have licenses and are regulated by government bodies. If the proposed scheme has not provided the necessary documents or information about its regulator, this is clear evidence of fraud.

Investing in Pyramids: Risks and Consequences

Investments in financial pyramids are associated with high risks and can lead to significant financial losses. Given the structure of these schemes, the return on investment becomes impossible without the constant attraction of new participants.

In most cases, when the pyramid collapses, investors simply lose their money. There are known cases in history where only the first participants receive some profit, while most people leave empty-handed. Thus, participation in such schemes not only leads to loss of money but also creates numerous financial and emotional problems.

The pyramid not only destroys the financial well-being of individuals but also negatively affects social structures. Users lose trust in financial markets and banks, which can lead to people being less willing to share their finances with legitimate institutions, seriously undermining the economy.

Investment fraud very often leads to personal problems. People caught in such a scam, in addition to money and assets, may lose family, trust among loved ones, and sometimes even the most valuable – life, when they realize that they have lost all means of subsistence. Fraudsters deceive so skillfully that the investor does not even realize how they are taking out huge loans, and when the pyramid collapses, there is nothing to pay back.

How to Protect Against Financial Pyramids

Protection against financial pyramids is highly relevant today, so we have prepared for you useful tips on how to avoid ill-considered investments.

- Check reputation. Before entrusting your funds, research the company. Find out if it has licenses, registrations, and reviews from previous clients. Try to gather as much information as possible and do not make a final decision based on only one source.

- Be attentive to documents. Do not hesitate to ask for documents, as well as reports and financial statements. Unscrupulous schemes usually avoid providing transparent information. Legitimate companies welcome verification requests, so do not miss this point.

- Research market news. Regularly study information about financial markets and investments. This will help you better understand possible risks and protect you from various fraudulent schemes, such as financial pyramids.

Financial pyramids — are common schemes that lead to significant losses for investors. Knowing the signs and ways to recognize such schemes, as well as developing your financial literacy skills, will help avoid falling into the traps of fraudsters. Remember that safe investments cannot be high-return and risk-free, and always question offers that seem too good to be true. Be careful, research, and protect your finances.

>

>