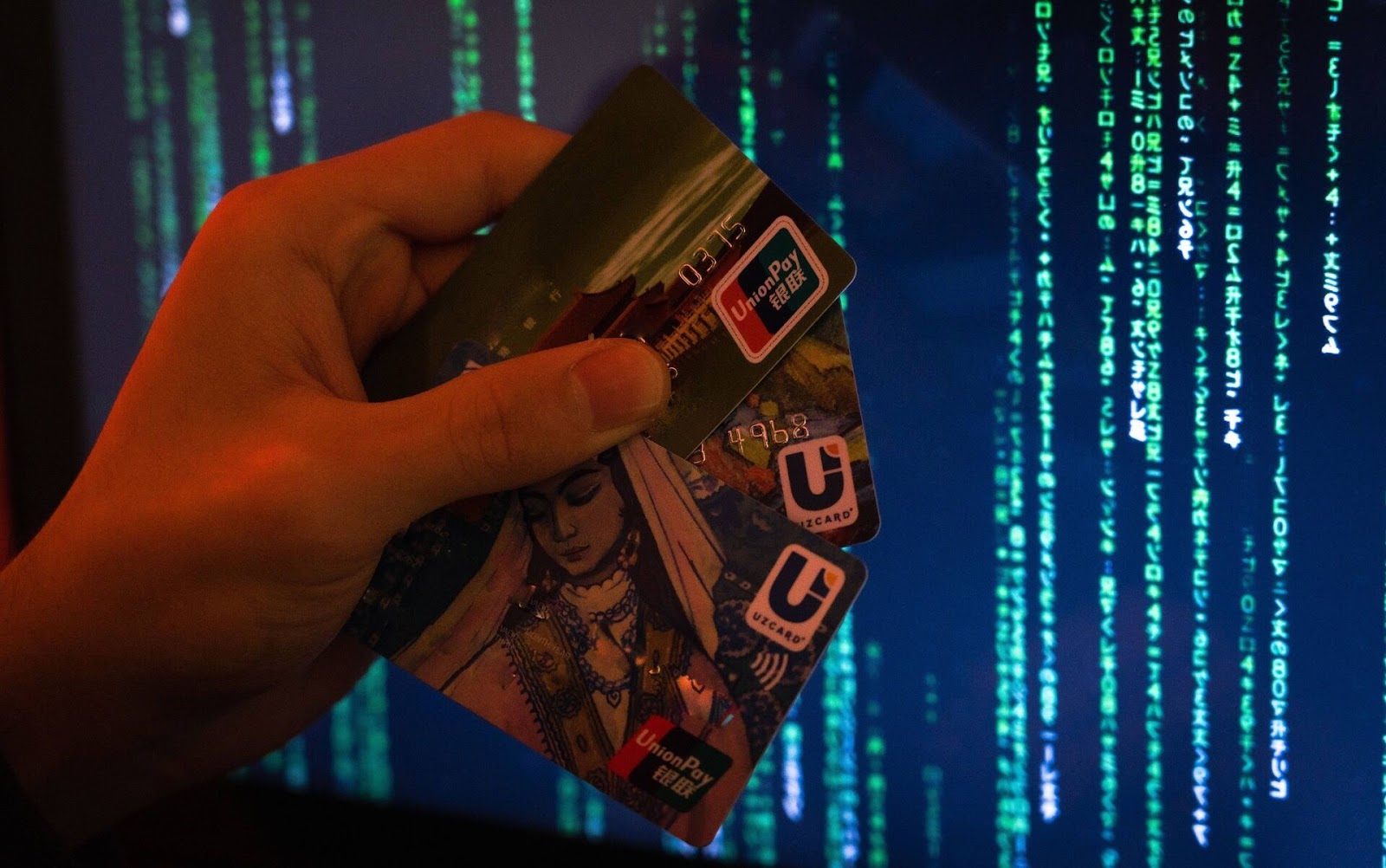

The development of electronic payments has significantly simplified the process of purchasing goods and services. However, along with convenience came new risks. Some users face situations where funds are debited from their card without their knowledge. Such cases are often associated with schemes like carding fraud and chargeback fraud. Both schemes are actively used by criminals and pose a serious threat to bank card holders.

Card Fraud: Modern Tools

Despite different implementation methods, chargeback fraud and carding are based on vulnerabilities in the digital environment and weak transaction control by users. Carding is used to debit funds from payment cards of victims whose data falls into the hands of criminals. The sources of leaks are most often phishing pages, malware, or poorly protected websites.

Chargeback fraud, in turn, uses the refund function but for fraudulent purposes. Instead of legitimate buyer protection, this method becomes a way to unjustly refund money after receiving the goods. Such schemes are successfully implemented due to simplified access to services that allow IP address substitution, device masking, and card data generation.

Technologies Used by Criminals

Most card scams become possible due to technological progress. Criminals use special software that provides selection of card number combinations and also determines on which sites quick purchases are possible without additional checks.

To carry out carding fraud, programs are used that analyze the database of stolen cards for solvency. After confirmation, goods or services are selected whose purchase will not arouse suspicion. Payment often occurs with the participation of fake sites disguised as stores.

In the case of chargeback fraud, another tactic is used. A purchase is made with a real card, then a demand for a refund is made. The reason is supposedly an unauthorized payment. The lack of physical contact with the seller and supporting documents for the transfer of goods allow funds to be returned through the chargeback system. This mechanism was originally created to protect the client, but in this case, it works against the interests of the seller. Thanks to such conditions and special programs that can be easily purchased, participating in such schemes can be done not only by professional cybercriminals but also by ordinary users with minimal technical skills.

Common Mistakes and How to Avoid Them

The majority of fraudulent transactions become possible due to the low awareness of users and weak protection by platforms accepting payments. Sometimes criminals do not even need to apply complex technologies – it is enough to exploit the negligence of the victim.

Leaving card data on trusted resources, ignoring bank notifications, disabling transaction control — all of this is actively used by criminals. The same applies to organizations that do not apply buyer identity verification, multi-factor authentication, and tracking suspicious behavior during payment.

The actions of fraudsters are aimed at creating the illusion of a regular and legitimate financial operation. Both the purchase of goods and the refund, and the appeal to the bank — all go through familiar channels and do not raise suspicion. To minimize risks, you should pay attention to the following security measures:

- using a separate card for online payments with a minimal limit;

- mandatory enabling of notifications for all transactions;

- regular checking of transaction history and contacting the bank in case of any suspicions;

- blocking the card in the event of unplanned transactions;

- using antivirus software on all devices;

- payment only through verified services with a secure connection (https).

Such basic precautions significantly complicate the implementation of fraudulent schemes. All this does not require much effort and will not take much time, but it will prevent fraudsters from implementing their schemes.

Why Fighting Scammers is Becoming Harder

Scamming with payment systems is actively developing, and preventing criminals' schemes is becoming more difficult. This is due to the growing number of services with unreliable verification and the international nature of financial operations. A transaction can be made in one country, the card issued in another, and the goods received in a third. This significantly complicates both the investigation and the refund. Even if the fact of fraud is established, returning the money is impossible without the involvement of all parties.

An additional problem is the abuse of the buyer protection function. As a result, honest sellers suffer, especially in the digital product segment, where proving the fact of receiving the goods is very difficult. Increasing awareness, adhering to security standards, and improving the verification process are key measures capable of limiting the spread of fraudulent schemes and enhancing the security of online payments.

>

>