Investment fraud is a dishonest way of luring an investor into signing a contract to invest money in cryptocurrency, stocks, monetary projects, and various assets.

Investment Frauds

When dealing with a victim, fraudsters always provide guarantees in terms of performed work and high profits, provide information about commercial offers, and details about investment products or commercial operations.

Investment offers can be identified as fraudulent by several signs:

- incomplete and false information about the business field, its owners, and risks, associated with this business;

- false information claiming that the investment company possesses valuable patents and quality products;

- fictitious companies showing signs of a Ponzi scheme, repayment of investments to previous investors from the subsequent ones;

- incorrect use of investors' funds for personal interests rather than business purposes.

How Investment Frauds Work

One common method of fraud using investments is luring the victim to specially created fake websites of banks or brokerage companies. Offering courses on cryptocurrency, investment brokerage services, and other unclear investments, asking to deposit a large amount into the company's account or take a loan to increase profits.

This is achieved through social networks, where it's easy to place ads, send out blasts with links to websites or apps, and create fake accounts to communicate with potential victims. Fraudsters skillfully use these tools to lure people into schemes, preying on their desire to get rich quickly.

False Investment Schemes

The imagination of fraudsters knows no bounds; each year, they invent new deceptive tricks. One direction is investment schemes. Currently, virtual currency is gaining popularity, and fraudsters seek investors willing to invest in cryptocurrency, hoping for a high trading percentage. They also use victims as shareholders, offering to invest in highly profitable companies, which turn out to be fake, leaving the investor without money or shares.

Fraudsters also propose investments in profitable schemes, such as real estate, precious goods, expensive equipment, high-class cars, etc. They promise that after investing, there is an opportunity to sell at a higher price to profitable buyers and make money. Remember, the fraudster only thinks about self-enrichment.

Signs of Investment Fraud

To understand such schemes, it's necessary to recognize several signs of investment fraud. If one of these factors is detected, you can safely refuse the upcoming deal. If there are several such signals, it's a clear indication that the deal is deceitful:

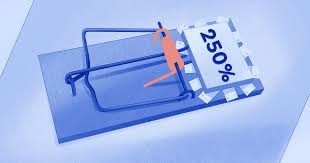

- Convincing promise of high income;

- Information about consistent profits over several years;

- Requirements to immediately invest money in the business;

- Concealing contact information;

- Convincing demands to maintain secrecy, not to tell anyone about the investments;

- Presence of fake reviews about a good company;

- Lack of registration and documents about the company's activities;

- Persistent offers to invest additional money;

- Claims of insider information.

High-Risk Investments

The most common high-risk investments are stocks, government bonds, promissory notes, and stock exchange trading.

There is an opportunity to earn a decent income, but such deals also carry a high level of risk. Trading cryptocurrency on the virtual market, investing in startups that might not succeed, trading on Forex with currency exchange rates, and investing in innovative technologies and venture funds with high growth potential are also unsafe. If a person is ready to take risks and invest in such opportunities, they should remember that business is not always profitable, and there can be losses.

Protection from Fraudulent Investments

The best way to protect against fraudulent schemes is vigilance. There are many offers in the investment market, and it's important to learn to distinguish false ones from truthful ones. As a rule, fraudsters lure victims by phone, call from unknown numbers, send SMS messages with ads and links. Links are also sent via email. Before investing money in a company, it's recommended to thoroughly study this area. Ask questions, check reviews, recommendations, visit the company's official website, verify if the firm offering you services is registered. To become an investor, it's advised to understand the risks and the essence of investments well, study information, and become a confident user, understanding investments to avoid falling into a scammer's trap.

>

>