The most common types of financial fraud include unauthorized attempts to withdraw funds from an account, suspicious requests for money transfers, and unique offers of lottery winnings – all of which are related to scams.

How do they deceive with money, and what to do if the scam succeeds? It is important to know as much as possible about financial fraud.

Fraud Schemes

The most common type of online fraud is financial pyramids. The scheme involves constantly bringing new participants into the project – this process never stops. Everyone is promised high returns – newcomers invest funds, which are distributed among the more «senior» investors. And so the cash flow of this system continues. However, newcomers never get to see their promised profits. Another popular type of financial fraud is investment scams. The financial markets are a goldmine for fraudsters.

Fraudulent brokers often persuade people to invest in imaginary projects that exist only as website pictures. As a result, investments in a non-existent company cannot be profitable. Thus, clients lose large amounts.

Types of Bank Fraud

It's not uncommon for people to receive phone calls from someone claiming to be from a bank. The use of innovative IP-telephony technology allows the real number to be hidden, with the official bank contact appearing on the client's phone during the call. Posing as an employee, the scammer might address the client by name and sometimes confirm information about connected bank services. This data can be stolen from open sources or phishing sites. Scammers carefully plan their strategies, often calling in the evening or early morning when people tend to process information superficially. Fraudsters use precise data and professional terms to avoid suspicion. They may inform about a suspicious transaction, for example:

-

an unauthorized person accessed the bank app account;

-

attempts to withdraw money from the card in another location;

-

a dubious transaction was made on the card;

-

a large payment was made.

Fraudsters claim that immediate actions are necessary to prevent further anonymous transactions. To avoid duplicated withdrawals, the following needs to be provided urgently:

-

Bank card details (CVV code, PIN code, card number, and expiration date)

-

A one-time code sent by the bank via SMS;

-

Follow the link sent to the phone.

If the scam is successful, fraudsters gain access to the account and the funds available in the balance.

Another scam involves SMS messages. In a notification, supposedly from the bank, a person sees a message like: «The active bank card has been blocked. For clarification, contact the phone...». Once the call is made, scammers transfer the victim to the bank's security service, represented by one of the fraudsters. The client follows the instructions of the 'specialists', who exert maximum effort to unblock the account and allow card usage. In reality, they quickly drain the card's contents.

Fraud from Government Structures

There is a less known scam, but the number of victims increases daily. The scam involves offering services from the administration – these can be various structures: healthcare, social security administration, pension fund. The goal is to inform about eligible payments according to a certain status. However, to supposedly receive the lawful payout, an official tax must be paid. Or the fee might be automatically deducted after providing card details. After payment, fraudsters guarantee the credited payout. But by the time the person (especially older individuals) realizes what happened, the money is already in the scammers' pockets.

Phone Fraud

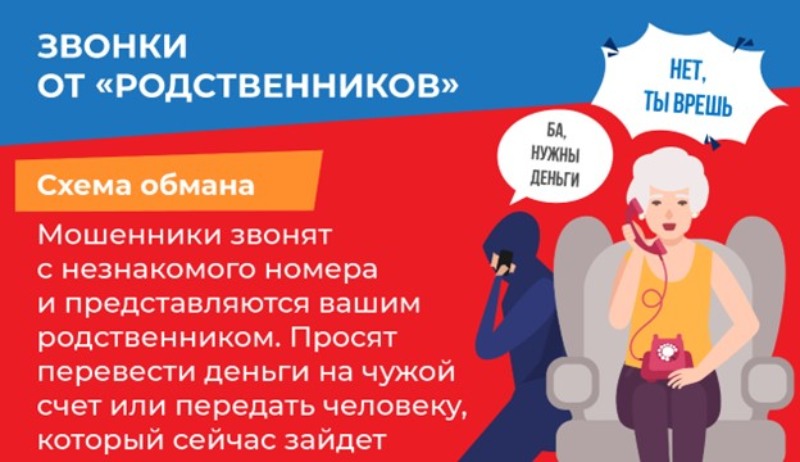

The most common fraud scheme is a call from a friend who is supposedly in trouble or in a hospital after an accident, urgently asking for help. Unable to contact them, relatives, friends, acquaintances – all who receive such a call in an emotionally unstable state, feeling stressed, start sending money to the specified card number to help the victim.

But the situation is entirely different. Only a few can «switch off» panic and act logically. Before sending money, one should contact the person who supposedly needs help to confirm the situation. But often the clock is ticking, and people, without wasting time, transfer large amounts in hopes of helping the victim.

Ways to Protect Against Scammers

No one is 100% safe from falling into a trap. Mistakes can happen to anyone. But it's crucial to know what information should not be shared with strangers.

To protect against internet criminals' attacks, it's important to follow certain rules:

-

Keep personal data a secret, not sharing any confidential card information with anyone;

-

Avoid performing account manipulations dictated by suspicious individuals over the phone;

-

For information verification, contact the bank directly, via hotline, or personally schedule an appointment with a financial specialist;

-

For details on legally mandated social payments/pensions, contact the specific department directly;

Before making any payments or card transfers, ensure the necessity of the transaction. Popular financial scams are not primitive – they become more creative with each passing day. Even the most focused user can believe in the presented «fairy tale». That's why it's essential always to remind oneself that the password for banking app access, card details, code word, PIN code, and other personal data should never be handed over to third parties. This rule must be repeated like a mantra during every suspicious phone call with questionable individuals.

>

>