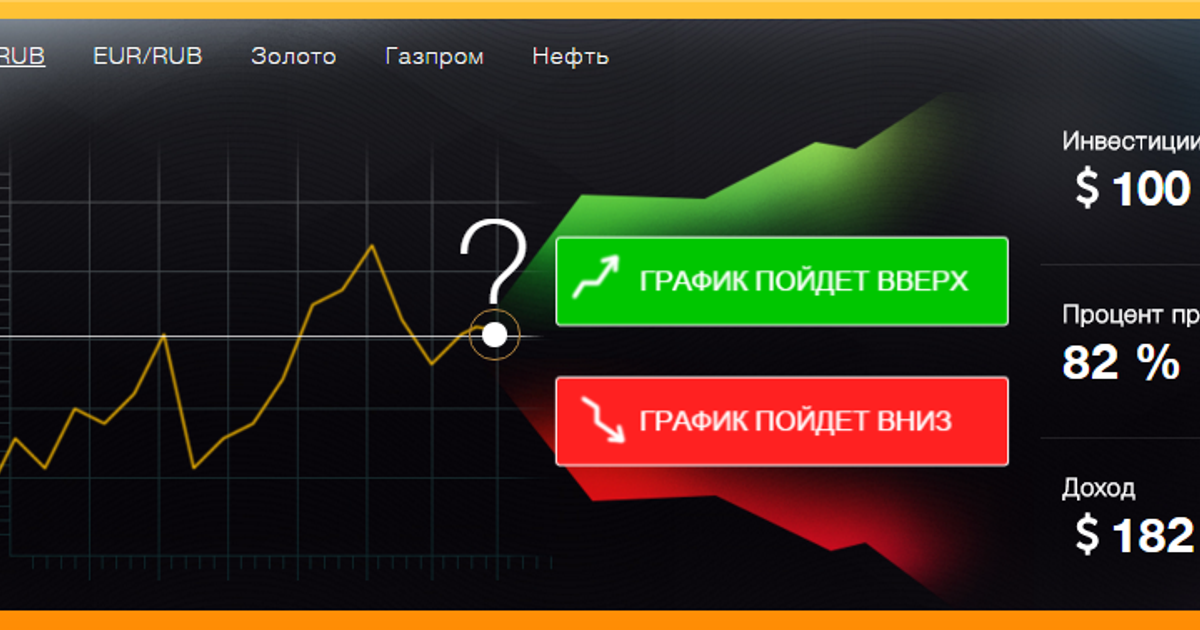

Binary options are a way to earn on price changes, for example, in currency, oil, or gold. Users are offered to guess whether the price will rise or fall in a short time. If guessed correctly, they earn a profit. If not, they lose money. It seems simple, but only at first glance.

Fraudsters use the simplicity of this scheme to lure people. They create websites that supposedly allow trading, but in reality, everything is controlled from one side. That is, no one is actually buying or selling real assets. The money simply goes from the user to the site owners. Because of this, binary options scams have become a common fraud scheme.

On such platforms, it is easy to fake results. For example, even if the forecast was correct, the site can change the outcome and show that the bet lost. Or they can suddenly close the deal prematurely, allegedly due to technical issues. All this is done intentionally so that the victim loses money.

High Risks: Site Independence and Verification Difficulties

Unlike real exchanges, where everything happens openly and according to strict rules, binary options sites often operate without oversight. That is, they do not comply with any laws and can do anything they want. This is why trading scams are most often found on such platforms.

When a user places a bet on a price increase or decrease, they do not see where this price comes from. It is only displayed on the site. Some platforms intentionally show incorrect figures, especially in the last seconds of a deal. This is done so that the victim loses in any case. This action is called quote manipulation, and proving it later is almost impossible.

The expiration time of the deal can also be changed. That is, the expiration time is the moment when the deal concludes. For example, if a user bets that the price will rise in 30 seconds, the site can extend this period or finish it earlier, at the moment when the price temporarily drops.

How Fake Platforms Appear

Many platforms offering binary options trading are registered in offshore countries. These are countries where user protection laws are weak or non-existent. In such zones, it is easy to open a company without revealing who is running it and without reporting to the government.

Because of this, even if the site turns out to be fraudulent, there may be nowhere to complain. And getting the money back is practically impossible. Some companies forge licenses to create a sense of reliability. At the same time, a person may not realize they are dealing with a fake platform, as there are phone numbers, support services, and even supposedly real documents. But in reality, all this can be fake.

Deception Through Advertising and Promises

Fraudsters usually spare no expense on advertising. They promise easy and quick earnings, showing stories of “successful investors” who supposedly got rich in a week. Personal communication is also used. Right after registration, a manager might call and suggest investing more funds, guaranteeing a quick income.

The user is convinced that such an opportunity is only available now and the sooner they fund their account, the faster they will earn. They might even show fake profits on the screen to entice larger investments. This is part of a premeditated scheme to extract money. The main signs of fraud also include:

- constant calls with offers to invest more money;

- guarantees of profits without any risks;

- demonstrating overly beautiful income statistics;

- attempts to persuade to invest more under the pretext of a temporary promotion;

- inability to withdraw even small amounts.

Such methods are designed for emotional impact. The user begins to believe in easy success. This is why the main losses most often occur. Recognizing schemes at an early stage helps minimize the chance of becoming a victim of fraudsters.

Problems with Refunds

As a rule, when trying to return invested funds, difficulties arise. The platform may suddenly require copies of documents to verify identity. Then technical errors, time restrictions, or simply silence may appear. This is a common occurrence in trading scams.

If a large sum accumulates in the account, the site may block the account, allegedly for violating some suddenly appearing rules. Sometimes support simply drags out time, hoping the user will give up and stop writing. All emails go unanswered, calls are ignored. Money cannot be returned because all decisions are made by the platform itself, and no one controls its actions.

The user does not always understand that they are in a fraud scheme. Until the moment of withdrawal request, everything can look like real platform work—with trades, profits, and support. This is why the high risks of investing in binary options are not an exaggeration, but a reality.

>

>