Fake notifications in the name of banks are one of the most favored methods of deception among fraudsters. SMS phishing employs not only social engineering but also technical tricks that make attacks undetectable. Scammers use malicious software and number spoofing systems to access personal data and orchestrate fraud with codes. Understanding the technical side of schemes helps better recognize the threat.

Criminals often bet on scale. With the help of special mailings, a large number of numbers can be covered simultaneously. This increases the chance of success in at least a few cases. Given the low cost of organizing such attacks, even one successful response brings significant profit to fraudsters. Therefore, fake bank SMS messages continue to spread actively, despite the growing awareness of users.

How Fraudsters Fake Bank SMS Messages

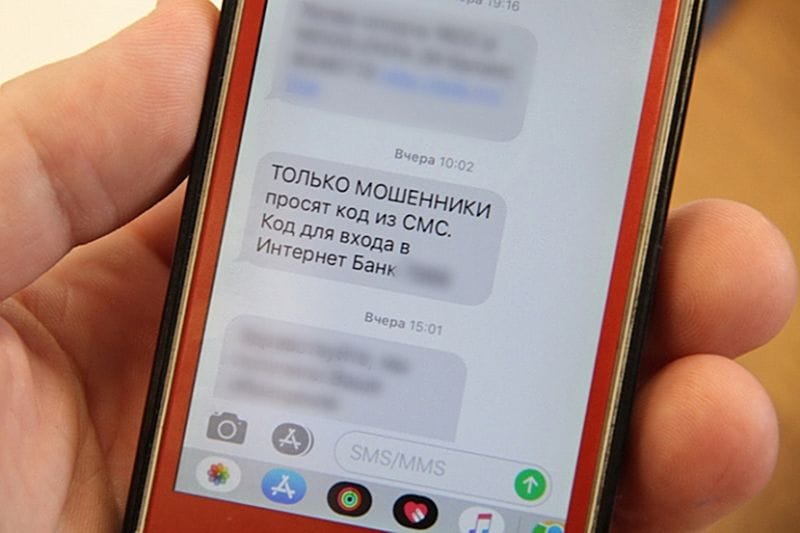

One of the most dangerous schemes is spoofing the number or name of the sender. This allows fraudsters to make a message look official, as if it came from a real bank. Sometimes such an SMS even ends up in the same conversation where real notifications were previously, making the deception particularly convincing.

To send a fake message, fraudsters exploit vulnerabilities in messaging systems. Some services allow sending SMS where any sender name can be specified. Such platforms are often used by companies for advertising, but fraudsters often gain access to them too.

Messages from fraudsters look very realistic. They may mention debits, login to a personal account, card blocking, or a request for code confirmation. Often the texts are crafted in a way to cause alarm and prompt quick action. The difficulty is that the victim cannot distinguish such a fake from a real notification.

Malware as a Tool for Data Interception

To expand the capabilities of the attack, fraudsters use malicious applications disguised as useful services. After installation, they request access to SMS, notifications, and contacts. Some of them can automatically read confirmation codes and send them to third-party servers. This allows bypassing account protection without user involvement.

In some cases, an application may copy the interface of an official online bank. As a result, data is entered into the fake application, leading to a leak. Such software is often downloaded not through the official store but via a link from a message or messenger. Given that many do not check installation sources, the risk of infection remains high. This way, fraud with codes and the collection of logins, PINs, and other confidential information is implemented.

Ways to Counteract Phishing Messages

Modern fraud schemes are becoming more automated, and visual signs of forgery are almost imperceptible. Therefore, protection must be systematic, including both technical and behavioral measures. Mere attention to text style is no longer enough. It is necessary to consider device behavior, application sources, and security settings. To reduce the likelihood of falling victim to SMS phishing, it is important to follow these rules:

- install antivirus programs with SMS filtering capabilities;

- check permissions of all applications and disable access to messages;

- download applications only from official stores;

- disable installation from unknown sources in device settings;

- use built-in protection mechanisms in banking applications;

- monitor device behavior—unexpected reboot, overheating, or appearance of unknown icons may be signs of infection;

- verify the sender of each message and do not click on suspicious links.

It is impossible to completely eliminate all threats, but smart behavior and technical measures combined can minimize damage. It is important to regularly review settings and monitor system security updates.

The Human Factor: The Main Vulnerability of the User

Despite the variety of digital filters and security settings, most attacks are still implemented due to the gullibility of victims. The use of phishing notifications and psychological tricks is a constant component of schemes. Even the most reliable protection of bank cards loses effectiveness if the user provides a one-time code from a message to third parties.

Deception methods are often combined. After receiving a fake SMS, a call supposedly from the security service may follow. As a result, an illusion of urgency and importance of the situation is created, requiring immediate response. The spread of fake bank notifications is not isolated cases but a systematic phenomenon. Increasing digital literacy and regularly updating protection mechanisms are key elements of resilience to modern attacks.

>

>