One of the common types of fraud is phone fraud. Using this method of deception, fraudsters try to gain confidential information and banking data. Although people are vigilant, the number of phone fraud victims increases each year.

How they deceive over the phone

One common method is cold calling. Using a stolen database of bank customers, fraudsters pose as financial institution employees, reporting issues with a card or account that require immediate information such as the CVV code, password, PIN code, and other banking details. The biggest danger is that such calls exert high psychological pressure. An immediate decision is required.

This is done to ensure the victim doesn't have time to reconsider and mentally weigh all the information received. Quick decisions will not lead to a positive outcome, but rather the opposite.

The second type of phone fraud is phishing, which involves receiving various emails or a large number of SMS messages containing a fraudulent link. One needs to follow this link to resolve the issue. By clicking on such a link and entering banking details, it is possible that funds will be stolen from the account.

Phone Scams

There is a lot of information about phone scams, yet people constantly fall for fraudsters' tricks. There are several steps to take if you become a victim of a scammer and your banking data has been disclosed:

- Call the bank (you should contact the bank's specialists using the phone number indicated on the card and report that banking secrecy has been disclosed);

- Block suspicious transfers or card actions (it is essential to block these transactions and the card);

- Monitor your accounts in online banking (helps to keep track of funds if suspicious activities arise) and submit an online application to the bank.

Protection from phone fraudsters

To protect yourself as much as possible from fraudsters and not become a victim, you should follow a few simple rules:

- It is necessary to check the website where you are required to enter banking data and payment information in advance (a genuine banking institution always has an official website), when following a link from an unknown source, be cautious and double-check;

- Do not disclose one-time passwords or CVV codes written on the back of the card to anyone (bank employees never request such data via SMS or directly over the phone);

- Do not pay attention to unclear messages, suspicious emails, and their attached links; if they are written poorly, this should raise suspicion;

- Be vigilant when receiving calls from unknown numbers claiming to be from the bank (in this situation, it's better to call the bank yourself to confirm the call).

How not to become a victim of a scam call

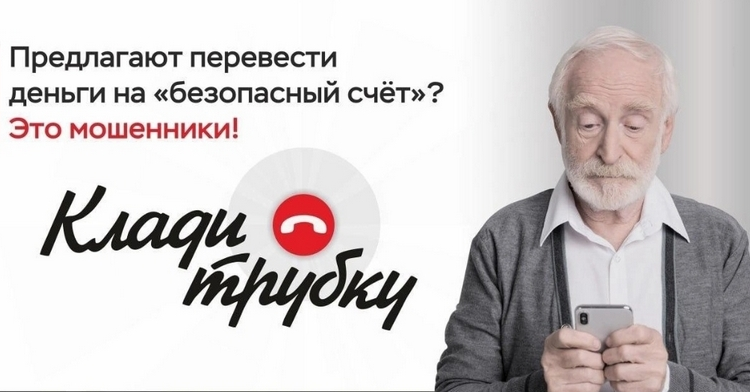

To avoid becoming a victim of a scam call, you should be careful and judicious, not fall for quick offers, ask more questions, and be inquisitive. Fraudsters can't calmly answer questions for long and will reveal themselves with impatient conversation. It's better to ignore such calls. But if it happens and you have to talk, the main thing is to engage critical thinking, weigh each response. The simplest way is not to answer unknown numbers or suspicious questions, hang up immediately, and possibly block the subscriber.

Often calls may come from different phone numbers and become real spam. If you don't respond to these numbers and hang up, the calls may stop soon, and the fraudsters will realize they can't catch a fish here.

Fraudulent Calls

Fraudulent calls look like:

- Insistent advertising of quick earnings,

- Applying for a quick loan,

- An offer of enrichment that is impossible to refuse.

Fraudsters often try to engage the client in conversation, forcing them to make an instant decision, disclose their banking details, or reveal the amount they possess. All this happens under great psychological pressure so that the person doesn't have time to orient themselves and falls into the fraud trap. Fraudsters may also pose as bank employees asking for personal data in banking or on the card. It should be remembered that bank employees do not ask for information about passwords or PIN codes.

Honest people find it hard to understand that they are being deceived and may be left without funds, which is exactly what phone fraudsters take advantage of.

>

>